GLG RI Sustainable European Income

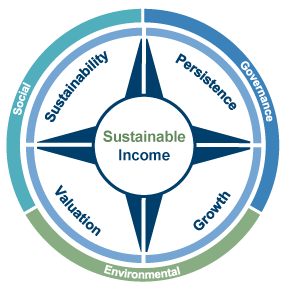

GLG RI Sustainable European Income (the ‘Strategy’) is a long-only, European equity income strategy with sustainability at its core from both a financial and ESG perspective.

- Managed by Firmino Morgado (+25 years’ experience) and Filipe Bergana (+15 years’ experience)

- A proven 5 year track record of managing a European equity income strategy

- Active management is paramount, the team aim to construct a high conviction portfolio of 25 to 35 positions with income sustainability at its core. The Strategy blends two dividend categories:

- Dividend Yielders – stocks that have a high, sustainable dividend (>4%) but moderate growth potential

- Dividend Growers – stocks that have a moderate dividend yield but have high growth potential (>5%p.a.)

- Focused on sustainable responsible investment having developed systematic process via a proprietary ESG tool which identifies specific targets through a science-based approach

- Deep synergies with Man GLG’s European Equities stock picking team – numerous sector specialists provide an analytical edge

You are now exiting our website

Please be aware that you are now exiting the Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Group related information or content of such sites and makes no warranties as to their content. Man Group assumes no liability for non Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Group.