Alpha generation of the long portfolio

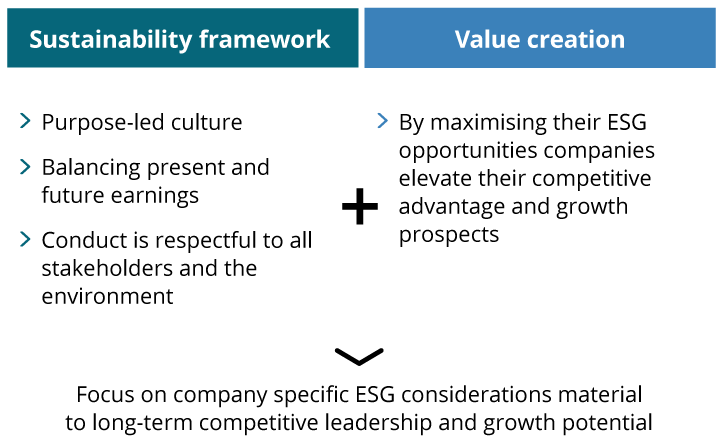

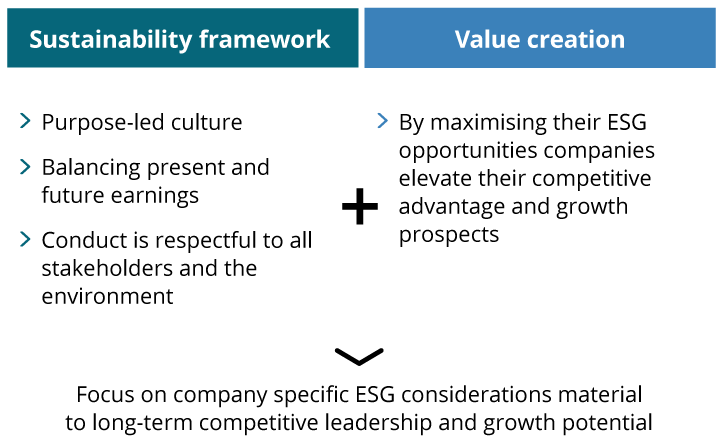

The long portfolio focuses on generating alpha by investing in 25 to 45 holdings that the team consider to be the world’s strongest companies. These companies share common attributes such as demonstrable competitive advantages, pricing power, robust profitability, balance sheet strength, attractive ROICs, and leadership in sustainability. To qualify for the long portfolio, the investment team must be confident that a company can meet, or has the potential to meet, the parameters set out in its Sustainability Framework (below) and must demonstrate the ability to create value in the pursuit of fulfilling these sustainability criteria.

Companies that meet these criteria will be considered for inclusion in the two-tiered long portfolio. 60-100% of the long portfolio will be invested in the Core - companies that meet all six of the team’s investment criteria of formidable competitive leadership, purpose led culture, resilient and growing revenues, robust profitability, attractive cash flow characteristics and reporting on greenhouse gas emissions. A maximum of 40% of the long portfolio will feature companies that are on track to meet the criteria within five years.

Design of the short book

The short book is designed to compress volatility, control net exposure and to reduce the factor exposure of the long portfolio to leave as much idiosyncratic risk as possible. The bulk of the short book is run in a fundamental agnostic way and comprises of index shorts and a highly diverse multi-stock portfolio, with characteristics that closely match the long portfolio. The short book is also designed to leave the ESG bias unhedged or even boost it further by only shorting neutral or low score ESG companies. Further, there is an alpha short book that can express single stock positions up to 25% of NAV.

These risk guidelines and/or limits are provided for information purposes only and represent current internal risk guidelines. There is no requirement that the Strategy observes these limits, or that any action be taken if a guideline limit is reached or exceeded. Internal guidelines may be amended at any time without notice.

Integration of sustainability

The team looks to invest in companies that have competitive leadership positions, demonstrated staying power thanks to their innovation firepower and agility, and an all-stakeholder approach. The team strongly believes that companies can only thrive if they operate in a healthy ecosystem where they take care of the interests of all their stakeholders, including the environment.

As such the strategy fully integrates ESG into its investment process and applies a stricter variation of the Man Group RI Exclusion List that precludes it from investing in companies involved in controversial arms, tobacco, nuclear weapons, and companies that have greater than a de minimis amount of revenues associated with coal production and coal based energy. The team also excludes companies that fundamentally conflict with their sustainability metrics, and those that do not have the potential of meeting sustainability goals within five years, as defined by the team. The team also has an explicit focus on driving towards a low carbon economy, by making GHG emissions disclosure a requirement for inclusion into the Core of the portfolio.

Investment talent collaborating with technology, RI and stewardship experts

The strategy is managed by Rory Powe who is an experienced portfolio manager with a strong track record of delivering alpha. He works closely with Virginia Nordback on the long portfolio. Ikitsa Anastasov leads the design of the short book, along with Rory, and has extensive experience with long-short strategies. They are supported by four dedicated analysts. Man GLG’s Quant Research team provides expertise on quant and alternative data, while Jason Mitchell acts as ESG Adviser. Additional expertise is provided by Man Group’s Stewardship Team, which is responsible for engagement activities.

| Approach |

Alternative |

| Asset Class |

Equity |

| Geographic Focus |

Global |

You are now exiting our website

Please be aware that you are now exiting the Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Group related information or content of such sites and makes no warranties as to their content. Man Group assumes no liability for non Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Group.